Claim settlement ratio and its impact on Insurance Industry

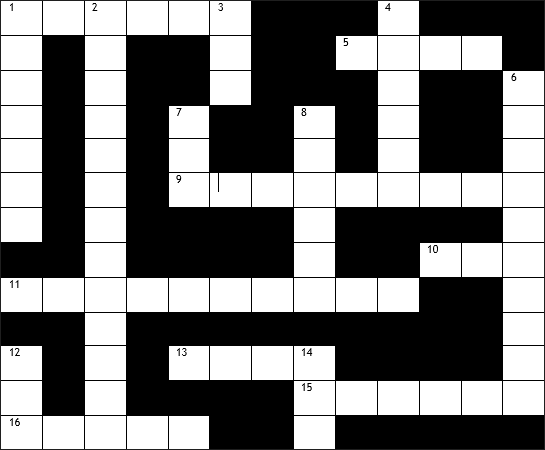

The claim settlement ratio, in life insurance, is a metric used to gauge the percentage of life insurance claims an insurer has settled during a financial year against the number of claims it has received including pending claims from the previous year.

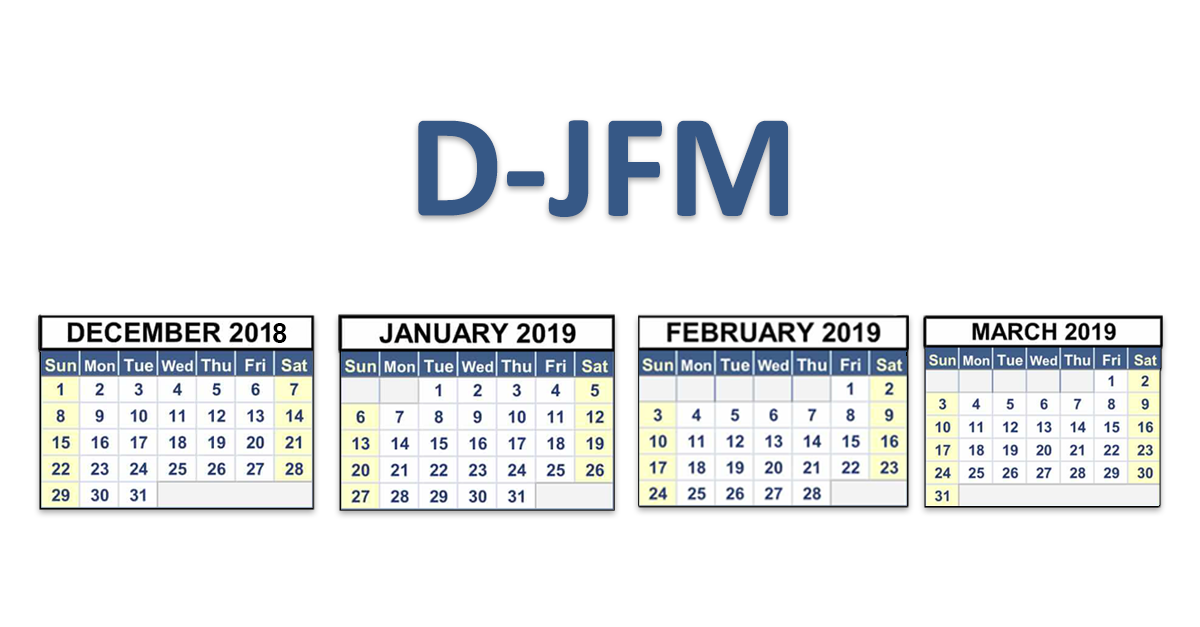

Another JFM!! So what else is new?

We have survived two years of the COVID 19 pandemic. In the last two years, we all have made drastic changes to our everyday lifestyles and how we go about doing things. As soon as we feel the pandemic is about to end, a new variant of coronavirus emerges. No one knows when the uncertainties of the pandemic will cease.

Myth vs Fact #7

Corona has been around for over 2 centuries and it is not going anywhere sooner! Like all viruses, Corona also is mutating - and continuously!! The SARS-CoV-2 virus has mutated over time, resulting in genetic variation in the population of circulating viral strains over the course of the COVID-19 pandemic.

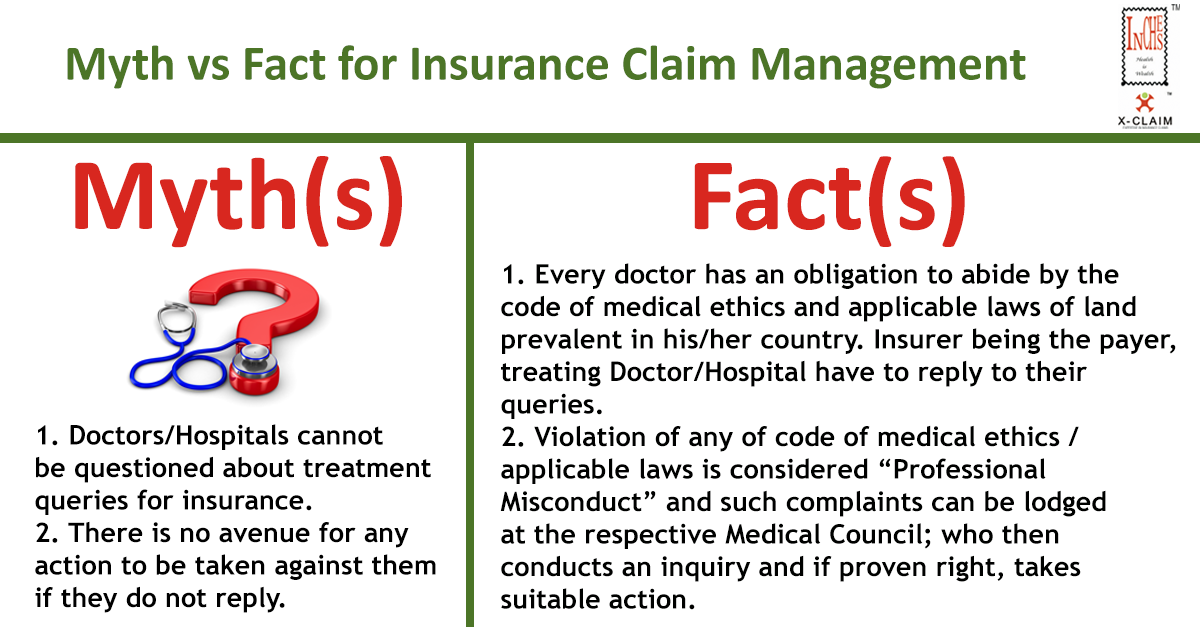

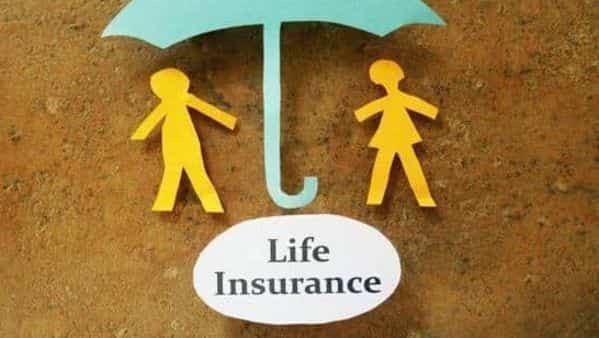

Myth vs Fact #5

Despite the race of offering unique cover in health insurance, insurers are some how wary of offering cover for mental illness. The common fear/ concern is of abuse. It seems there is comfort in having an umbrella of denying all claims relating to psychological complaints/ ailments. Truth is something different.

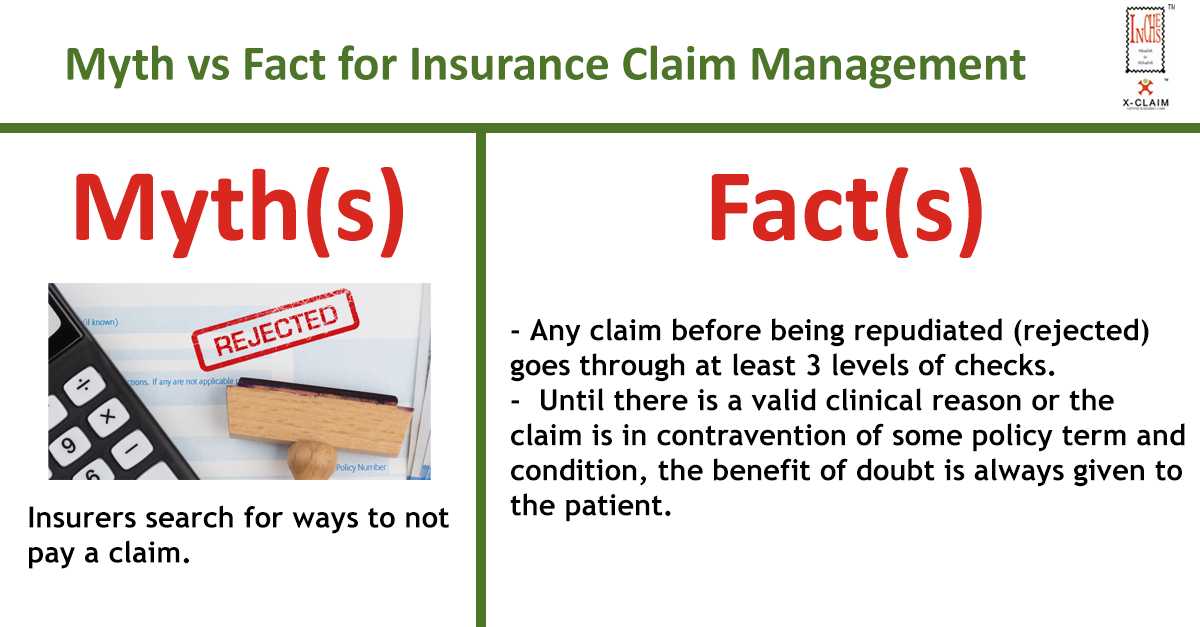

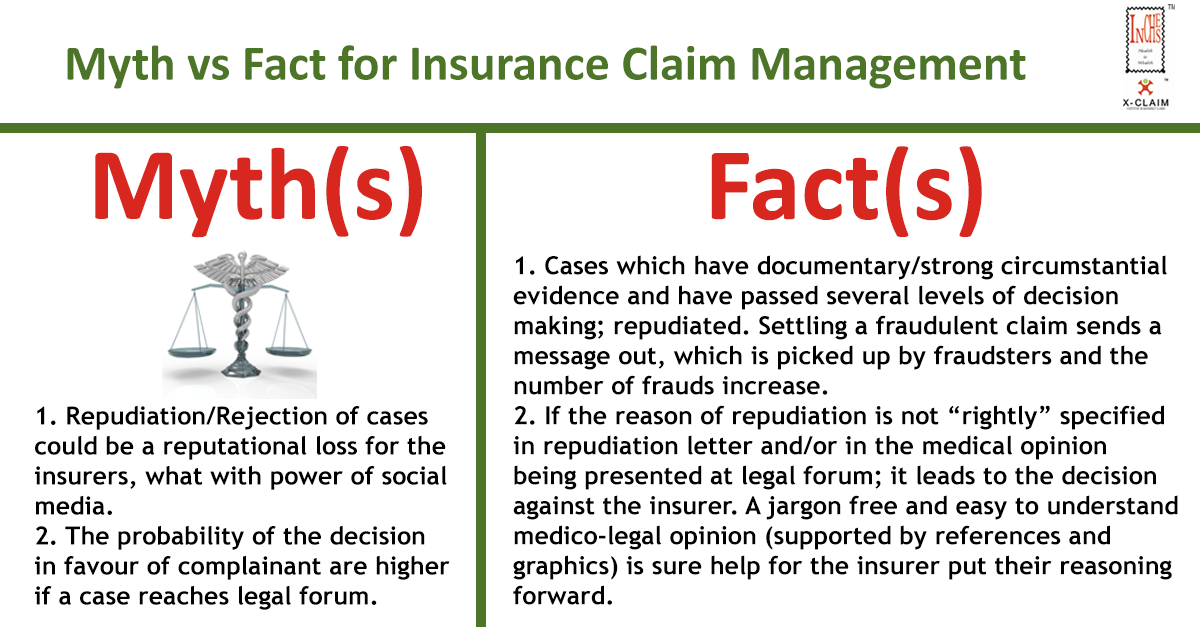

Myth vs Fact #3

There are multiple levels of adjudication before an insurer decides to repudiate a case. Despite such diligence there is always a worry whether this would jeopardize their reputation and should it go to a legal forum, the decision may be against them. Let us shatter this myth.

Case Study #2

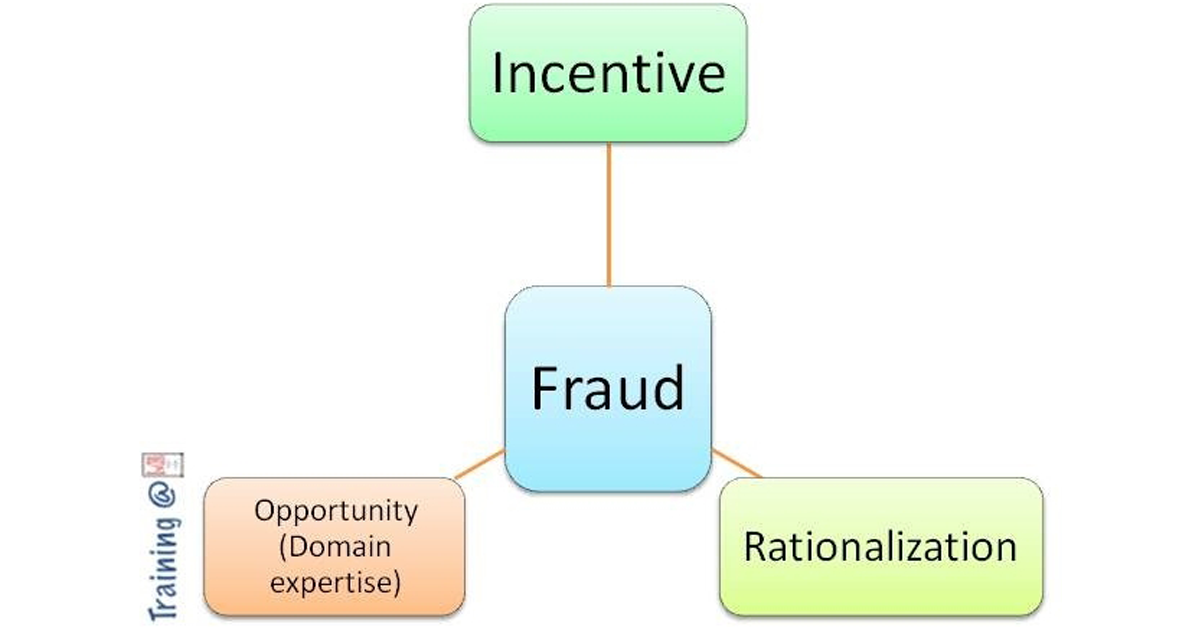

As, Covid Pandemic has resulted in mass sufferings and pains to the masses; for the insurance sector it has generated massive revenue loss. The losses were compounded by fraud and abuse perpetrated both by consumers and provider. INCHES was instrumental in helping insurers face these fraudulent activities and save several crores of Rupees.

Case Study #1

Dengue has been a debatable topic w.r.t. a mosquito bite being

considered accident and many policies overseas exclusively cover

infections due to mosquito bites under a special clause in PA policies.

But in India, where the PA policies do not mention such specific

clauses, are claims of dengue yet payable?