Claim settlement ratio actually implies prudent underwriting

By,

Mr Abhishek Lolayekar -

VP - Operations -

INCHES

Healthcare Pvt. Ltd

The claim settlement ratio, in life insurance, is a metric used to gauge the percentage of life insurance claims an insurer has settled during a financial year against the number of claims it has received including pending claims from the previous year.

Claim settlement ratio = Number of claims settled/ Number of claims lodgedX100

Claims may be rejected by life insurance companies for various reasons such as misrepresentation of facts, fraud, impersonation etc. It is hence important to ensure that accurate information is provided to the insurer at the time of purchase. With Section 45 (According to Section 45 of Insurance Act, a Life insurer has to compulsory settle all claims pertaining to policies which are more than 3 Years old) applicable to life insurance industry, the insurer has a tough task to evaluate the risk at issuance stage.

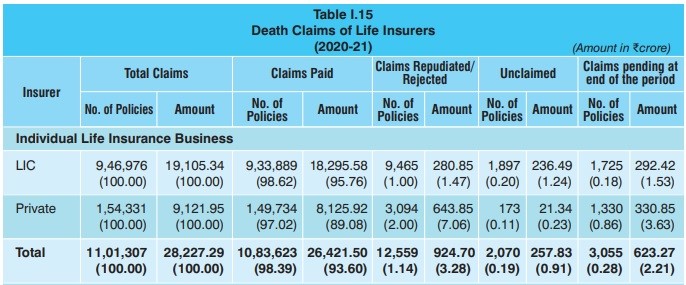

According to the Insurance Regulatory and Development Authority of India’s (IRDAI) annual report for 2020-21, “In case of individual life insurance business, during the year 2020-21, out of the total 11.01 lakh claims, the life insurers settled 10.84 lakh claims, with a total benefit amount of Rs 26,422 crore. The number of claims repudiated was 9,527 for an amount of Rs 865 crore and the number of claims rejected (claims were not processed due to technical errors in submission, i.e. incomplete documents, delayed reporting etc.) was 3,032 for an amount of Rs 60 crore. The claims pending at the end of the year was 3,055 for Rs 623 crore.

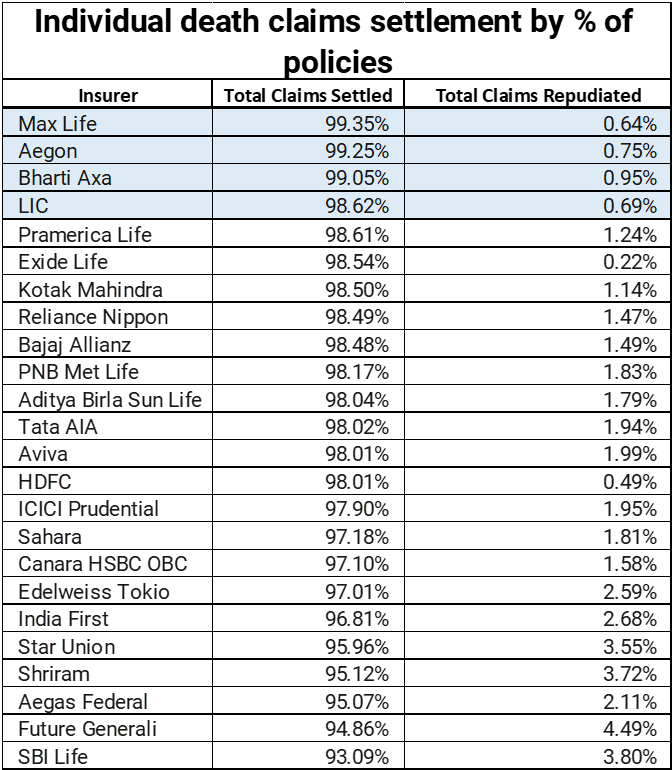

The claim settlement ratio of LIC was 98.62 per cent as of March 31, 2021, compared to 96.69 per cent as of March 31, 2020 and the proportion of claims repudiated/rejected has decreased to 1.0 per cent in 2020-21 from 1.09 per cent in the previous year. “The claim settlement ratio of private insurers was 97.02 per cent during 2020-21 (97.18 per cent during 2019-20) and the proportion of repudiations came down to 2.0 per cent in the year 2020-21 from 2.50 per cent in previous year. The life insurance industry’s settlement ratio increased to 98.39 per cent in 2020-21 from 96.76 per cent in 2019-20 and the repudiation/rejection ratio decreased to 1.14 per cent from 1.28 per cent in 2019-20,”

Claims repudiated is basically how many claims the insurer found to be invalid and hence, did not pay the claimed amount.

The COVID-19 pandemic has had huge cost implications to life insurers as a large number of people have lost their lives. Thus, the claim settlement ratio becomes a lot more crucial during pandemic led scenario to ensure that the insurance company is able to provide quality services to the policyholder, in the occurrence of a death, as committed by them without causing any financial blockage and ensuring financial support for the loved one who are left behind respectively.

Though these are the insurance companies with the highest percentage of claims settled, one needs to understand that the size of an insurance company also plays an important role in maintaining a higher claim settlement ratio. It becomes a challenge for bigger life insurance companies with a large policyholder base to remain in the top bracket in the claim settlement ratio table. And if they manage to do so, credit goes to unsung heroes – the underwriters! Prudent risk evaluation – more so in JFM – a virtual race against time – balancing both quality and quantum is worth applauding.

For a smaller insurer, it is easier to have tight control on the underwriting checks and balances at the time of issuing a new policy. These checks allow the insurance company to conduct a thorough investigation at the time of issuing a policy to avoid any policies which may have higher risks than acceptable underwriting parameters. The larger companies, by default, have more of large sums to underwrite. As the base grows, it becomes challenging to maintain the same quality of On scrutiny of documents, it is observed with galloping numbers.

Here is where INCHES steps in, INCHES’s Underwriting Support Services are One Stop Shop Solutions for Insurance companies, with no one-size-fits-all approach, INCHES offers exclusive & completely customizable solutions for insurance companies, bringing the entire set of Processes under a single umbrella.

We at INCHES, provide virtual clinical expertise that help insurers in deciphering medical facts and medical reports to raise the flags so that the underwriting team can calculate the risk, rationally.

Below are our services Pertaining to our UW SUPPORT.

- End to End Underwriting

- CMO Opinion

- ECG, TMT & other non-laboratory medical reports Interpretation

- Tele-calling Services for Tele & Video MER

- Counteroffer / Postpone Decline calling

- Review of underwritten cases and tele-calling done